Female Angels Aim To Give Women Entrepreneurs A Boost

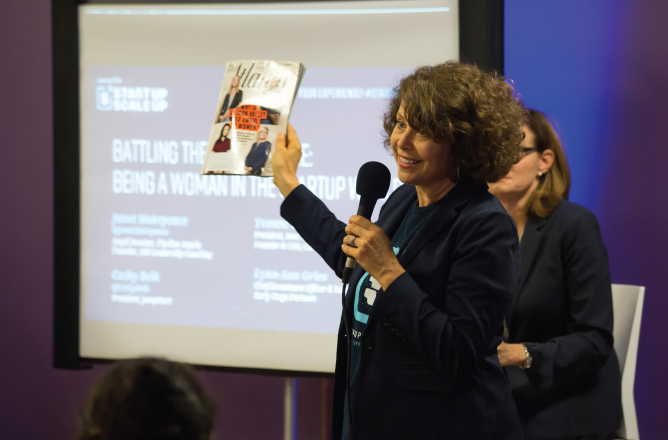

Recent headlines are full of stories discussing the male-centric “bro” culture that permeates the startup space. This issue was brought to the forefront once again at JumpStart’s third annual Startup Scaleup, which dedicated an entire workshop to the topic titled, “Battling the Bro Culture: Being a Woman in the Startup World.”

This year’s Startup Scaleup drew 1,400 participants to Gordon Square on Aug. 15 for more than 35 workshops, networking sessions and pitch competitions. The “Bro Culture” session packed the Near West Café with aspiring entrepreneurs, women business owners and their supporters eager to hear from a trio of women who work in the male-dominated world of angel investing.

The panel included Yvonne Campos, founder and president of Next Act Fund in Pittsburgh; Janet Makepeace, a Washington, D.C.-based angel investor with Pipeline Angels; and local startup funding expert Lynn-Ann Gries, the former chief investment officer at JumpStart and current investment professional with Early Stage Partners who is leading a grassroots effort to start a women-led venture fund in Cleveland.

One of the keys to helping more women get involved in the startup world – according to the trio—is to have more women making venture investment decisions. But, until women get a better foothold in early-stage investing, aspiring female entrepreneurs should “know their audience” when seeking out investors. According to workshop moderator Cathy Belk, president of JumpStart, only 3% of all venture capital is raised by women-led companies and 90% of investors who make decisions about the money that goes into companies are men. Panelists said leveling the playing field starts with educating women about angel investing.

They also offered some poignant advice to overcome that bias:

- Do your homework: Makepeace advised female entrepreneurs to research investors and find ones who are like-minded. Wise entrepreneurs are looking for human and social capital in addition to that cash infusion, she said, so try to identify investors who are willing to provide more than just financial support.

- Tailor your message: The bottom line is men and women often approach things differently, Makepeace added. Studies show men in leadership positions, for example, tend to be action oriented and focused on tasks while women are often more strategic. Be mindful of possible gender differences and what it means as you shape your pitch.

- Turn the tables: Gries suggested asking investors what they want. If they were to back your company, what would they like to see happen? “Are they looking for 10 times return in two years? Are they willing to give you money as a loan and you pay it back over a few years? There are lots of different ways that investors look at opportunities, so you should always be conscious of what they are looking for as well,” she said.

- Get help: There are a bevy of resources available from accelerators and pitch competitions to dedicated business resource centers. According to Campos, many of those resources go untapped. Local women-centric resources include the Women’s Business Center of Northern Ohio at the Ariel International Center in Cleveland and Aviatra Accelerators, formerly Bad Girl Ventures, out of Shaker Heights.

- Learn how to invest yourself: Learn all you can about venture investing. It will help you understand the process and practices of financing a new business now, but also better prepare you to be an investor yourself one day. “Many of you are going to be making a lot of money in your lifetime, so you need to know how to invest it,” said Campos.

Overall, the workshop made clear that it will take time and many more honest discussions to push back against the gender imbalance in the startup world, but bringing together successful women investors and giving them a platform to share their knowledge and advice is important part of this ongoing conversation.

This sotry originally appeared on Crain’s Cleveland Business.