Understanding Funding: The Stages Of A Typical Startup Company & Its Funding Options

Whether you’re a first-time entrepreneur or a seasoned pro, one of your first and most important tasks is to raise the capital you need to grow your venture. The good news is, there are more options than ever. The bad news is, it can sometimes be difficult to know where each option fits into your particular journey, especially when you’re just getting started.

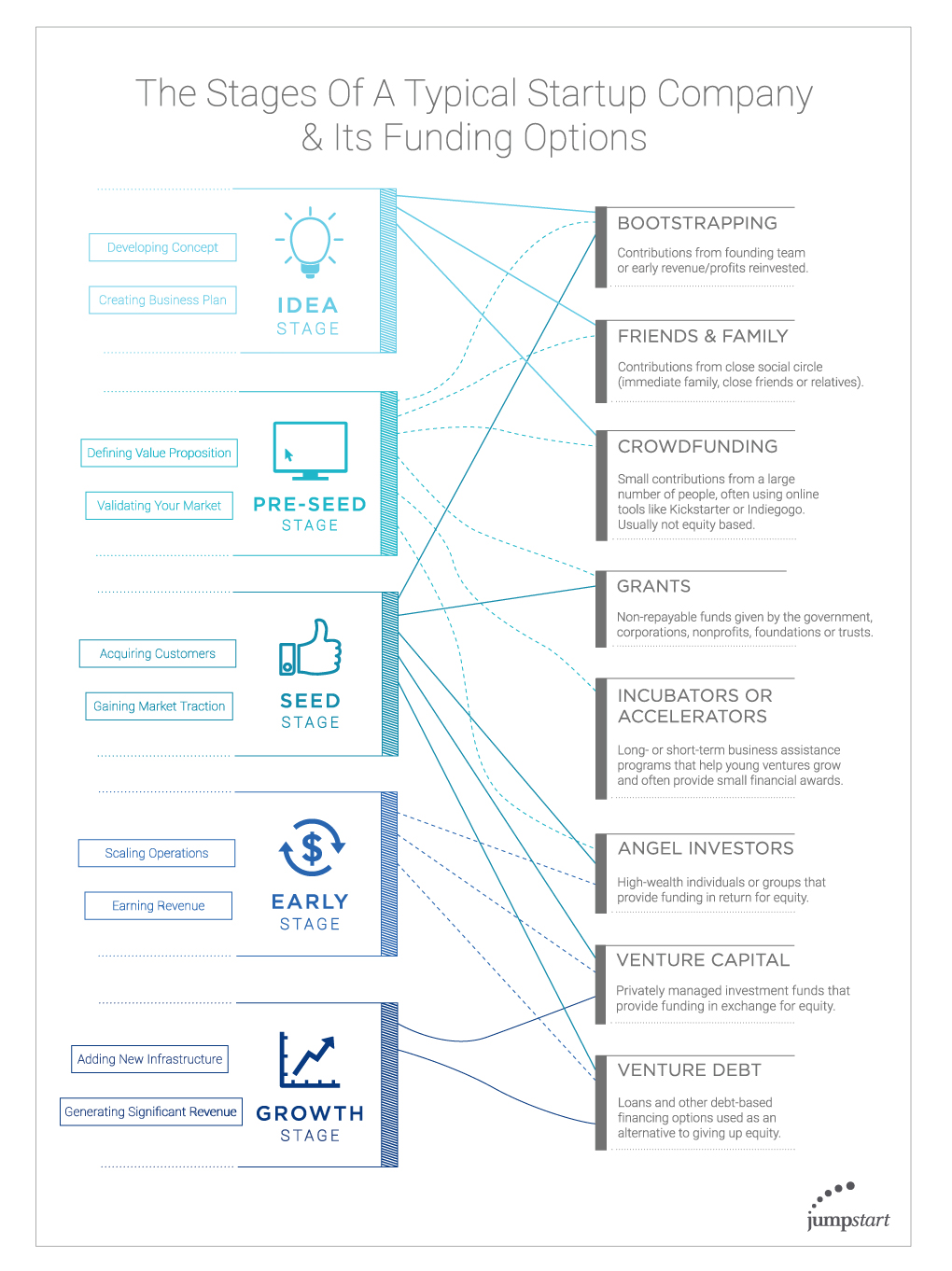

Let’s quickly review the various stages of a startup and the common funding opportunities available at each of these milestones:

Idea Stage

As an idea stage startup, your top priorities will include developing your concept and fleshing out a business plan.

At this stage of the game, without a validated product or service, your funding options will be limited to bootstrapping, seeking contributions from friends and family and crowdfunding.

Pre-Seed Stage

If words like customer discovery, market opportunity and minimum viable product (MVP) sound familiar to you, you’re most likely a pre-seed startup. This means you’re also likely to be working toward defining your value proposition and validating your market.

The pre-seed stage offers the greatest variety of funding options of any of the startup stages. This includes bootstrapping, contributions from friends and family, crowdfunding, grants, financial awards from incubators/accelerators and support from angel investors.

Seed Stage

During the seed stage, you begin executing against your idea. At this point, you will have started to acquire customers and gain market traction, but haven’t yet been able to repeat your success over and over.

Looking to develop a formula to go bigger, startups in this stage may continue bootstrapping or begin seeking opportunities to secure dollars from grants, angel investors, venture capital and venture debt.

Early Stage

You’ll hit this milestone when you have solidified a repeatable sales model that earns your company consistent revenue. Arriving at this stage of business also means you’re probably looking for a big infusion of capital to begin scaling operations.

As an early stage startup, you’re most likely to explore funding options that include angel investors, venture capital funds and venture debt.

Growth Stage

Startups that have reached the growth stage have demonstrated unmistakable progress in the company’s development. These companies are generating significant revenue and looking to add new infrastructure to further scale their businesses.

Once your company has reached this stage, your funding options will have become much more limited, with venture capital and venture debt being the primary sources of financing substantial enough to make a true impact on your operations.

For easy reference, our investing team developed a handy matrix. It tracks the entrepreneurial journey from the back of the napkin to the boardroom and connects each stage with the typical funding options entrepreneurs use to keep things moving along.

Obviously, no two ventures are the same, and there are exceptions to every rule, but this matrix provides a basic roadmap many startups use on their way to profitability.

To learn more about the ways JumpStart provides capital to growing startups, click here.